外商投资企业利润转投资递延纳税优惠政策明白纸

外商投资企业利润转投资递延纳税政策是国家进一步扩大对外开放,促进利用外资的一项重要政策措施。为全面落实总局、省局减税降费工作部署,充分发挥税收服务疫情防控和助力企业复工复产职能作用,泰安市税务局将创新税收服务与精准落实优惠政策齐头并进,采用中英文版编写了《外商投资企业利润转投资递延纳税优惠政策简介》和《享受递延纳税政策办税流程》,系统全面的介绍递延纳税优惠政策,明确梳理了业务办理流程,力争更好的帮助纳税人利用好税收优惠政策。

第一部分 外商投资企业利润转投资递延纳税优惠政策简介

PartⅠ A Brief Introduction of Deferred Tax Preference Policies for Profit Reinvestment of Foreign-Invested Enterprises

一、适用于外商投资企业利润转投资递延缴纳所得税的几种情形

Situations applicable to deferred income tax payment for profit reinvestment of foreign-invested enterprises are as follows

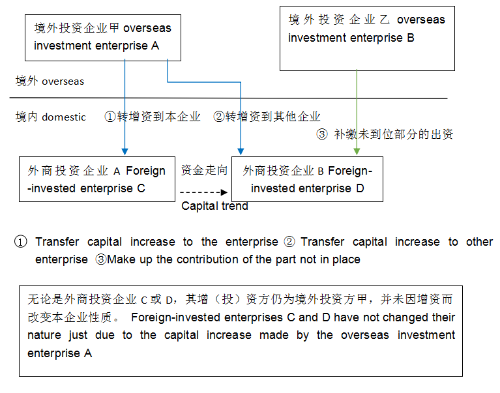

(一)境外投资者以分得利润进行的增资,新增或转增中国境内居民企业实收资本或者资本公积;境外投资者以分得的利润用于补缴其在境内居民企业已经认缴的注册资本、增加实收资本或资本公积的,属于符合此条的情形。

Overseas investorsreinvest with distributed profits. Overseas investors increase the paid-in capital or capital reserve of a domestic resident enterprise in China; overseas investors use the profits to make up for the registered capital they have subscribed for, or increase the paid-in capital or the capital reserve of a domestic resident enterprise.

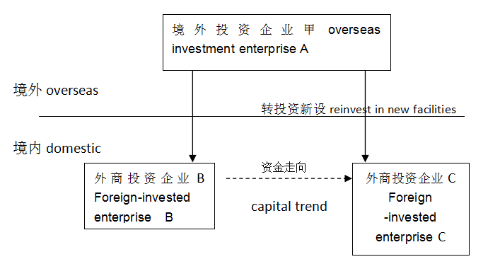

(二)境外投资者以分得利润进行的新建,在中国境内投资新建居民企业。

Overseas investors use the distributed profits to construct new residential enterprises in China.

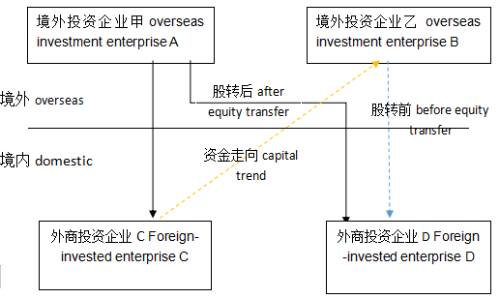

(三)境外投资者以分得利润进行股权收购等权益性投资,从非关联方收购中国境内居民企业股权。

Overseas investors make equity investment such as equity acquisition with distributed profits and acquire the equity of domestic resident enterprises from non-related parties.

(四)财政部、税务总局规定的其他方式。

Other methods prescribed by the Ministry of Finance and State Taxation Administration.

二、并非所有转投资的利润均可享受递延缴纳税收优惠政策

Not all profits from reinvestment are qualified for deferred tax payment

以下五种情况不可享受

The following five situations are not applicable

1.已经分配到境外投资方的利润,再汇回到境内进行增资或者投资的。

Profits which have been distributed to overseas investors are remitted back to China for capital increase or investment.

2.用未分配的利润转投资或转增资到中国境外,或用于收购境外的企业。

Undistributed profits are used to reinvest or increase capital outside China, or to acquire enterprises outside China.

3.用未分配的利润新增、转增或收购境内上市公司股份,但符合《外国投资者对上市公司战略投资管理办法》者除外。

Undistributed profits are used to increase, transfer or purchase shares of domestic listed companies, excluding those in line with the Measures for Strategic Investment Administration in Listed Companies for foreign investors.

4.用未分配的利润收购关联公司持有的境内企业股权。

Undistributed profits are used to acquire equity of domestic enterprises held by affiliated companies.

5.可享受优惠政策的转投的利润,必须是已经终了的会计年度所形成的未分配利润。

The profits that can be invested with preferential policies must be the undistributed profits from a fiscal year that has come to an end.

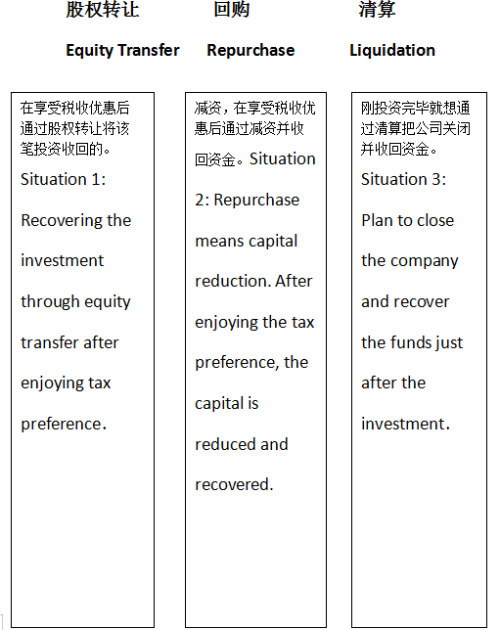

三、以下情形需补缴税款

The tax deferred needs to be paid in the following situations.

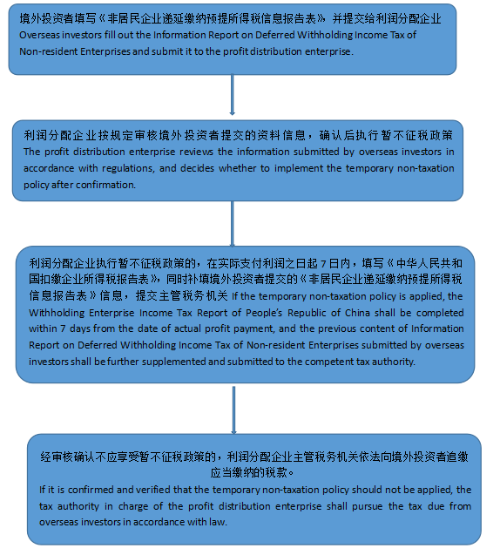

第二部分 享受递延纳税政策办理流程

PartⅡ The Implementing Process of Deferred Tax Preferential Policies